Bath’s economy will shrink by 10.6% this year as a result of the coronavirus pandemic but should recover strongly next year, according to a new forecast.

According to global accountancy group KPMG, the decline in the city’s gross value added (GVA) means it will be hit harder than for the UK as whole, at 10.3%, and the wider South West region at 9.4%.

The city’s GVA growth figure for last year was 1.3% – weaker than the national figure of 1.5%.

The firm’s latest quarterly Economic Outlook also forecasts Bath & North East Somerset’s GVA will experience a so-called V-shape recovery and grow by 9.9% next year – a figure which assumes a vaccine for Covid-19 will be approved in January, immediately reducing uncertainty, and rolled out by the end of April, enabling all social distancing measures to end.

It also assumes the UK and the EU reach an agreement on their future relationship before the end of the transition period this year. Even then, the national economy will not get back to its pre-Covid level until early 2023.

Bath’s forecast recovery in 2021 - – at 8.4% - is stronger than for the UK.

KPMG South West senior partner Andrew Hodgson, pictured, said: “This is an uncertain and demanding time for businesses in the South West. There are also mixed messages about how the consumer is reacting as we come out of lockdown and how sustainable any early signs of recovery are, especially when you consider that unemployment is growing and the impact of the unprecedented fall in GDP bites.

“Businesses are cancelling their investment plans and there is a concern that persistently weak business investment could hold back the UK’s recovery.”

KPMG’s forecast estimates that a second lockdown of just four weeks could exacerbate the drop in UK GDP to minus 12.6% this year.

Also, a three-month delay in rolling out the vaccine could mean GDP growth of 7.1% next year instead of 8.4%.

Other risks which could impact potential growth include a no deal with the EU next year and limited progress in eradicating the pandemic. If these play out, growth in 2021 could be just 4%.

Meanwhile, two other reports out this week further show the extent of the pandemic’s damage on the region’s businesses.

New research from Aldermore Bank, which specialises in funding small and medium-sized businesses, shows the average firm of this size in the South West has lost 38% of its income as a result of Covid-19, with 14% saying there has already been damaged long-term to the business.

Some 38% have adjusted their business plans to reflect the ‘new normal’. Action already taken ranges from shifting more business online (16%) to investing in new technology to operate remotely (13%)

Action by small and medium-sized firms in the region to reduce costs as part of their Covid-19 response plan with strategies have included:

- Decreasing operating costs and discretionary spending (26%)

- Furloughing staff (8%)

- Drawing on capital (7%)

- Withdrew savings (19%)

- Applying for a Coronavirus Business Interruption Loan (8%)

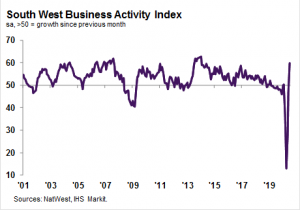

NatWest’s South West Business Activity Index – which measures the month-on-month change in the manufacturing and service sectors – showed a sharp increase in July as businesses emerged from lockdown.

The figure of 59.7 was up strongly on June’s 46.4 and was the sharpest rise in new work since January 2014 for the index, in which a level of 50.0 is no change.

The report says anecdotal evidence indicated that the easing of lockdown measures and the release of pent-up customer demand had helped lift sales.

It also said South West firms generally expected output to be higher than current levels in 12 months’ time. Optimism was supported by forecasts of improved market conditions, increased client confidence and plans to expand capacity.

However, employment levels fell again last month, with firms hit by the fallout from the pandemic making redundancies or not replacing staff who had left voluntarily.

NatWest South West Regional Board chair Paul Edwards said: “Businesses across the South West saw a strong rebound in business activity in July, as more segments of the economy reopened and clients got back to work following a relaxation of Covid-19 restrictions.

“At the same time, firms faced a steep increase in costs due to supplier shortages and increased staff expenses. This translated into a cautious approach to employment, especially as firms noted ample capacity to deal with current workloads, which led to a further marked drop in workforce numbers.

“As the government’s furlough scheme winds down, and the outlook remains shrouded in uncertainty, the path to recovery is likely to be a long one as firms will require a sustained upturn in demand conditions to return to pre-pandemic levels of activity.”