Regional accountants Old Mill have doubled the size of their corporate finance team to take advantage of a growing market while supporting the firm’s overall growth plans.

Last November the firm, which has offices in Chippenham, Wells, Yeovil and Exeter, unveiled its plan to grow by 15% a year for the next five years and to grow its overall staff numbers by 100% by 2026.

At the time its corporate finance team consisted of partner Mark Neath and adviser Kathryn Mansell.

As the team was experiencing a growing demand from business owners for its collaborative style of help and advice, particularly around succession plans, it was viewed as an obvious area for growth.

At the end last year Scott Hill was appointed from Danescor in London to focus on helping owner-managed businesses that are looking to make an exit.

Then in January Tom Downes joined the team from ‘big four’ accountancy firm PwC’s Bristol office to lead the financial modelling and valuations offering.

This additional experience and resource has enabled the team to expand its services, strengthen its expertise and offer more transactional support, as well as work on bigger and multiple deals.

It recently helped Golledge Electronics secure a sale to Techpoint (as reported by Bath Business News).

It was also integral in the acquisition of Atlas Packaging – a Devon-based firm that Old Mill has worked with since 2010 – by Smurfit Kappa UK.

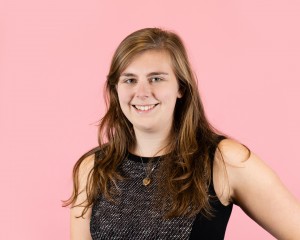

Kathryn Mansell, pictured, said: “The growth of the team has enabled us to really showcase our expertise across business sales, M&A (merger and acquisition), MBOs (management buy outs), due diligence and valuation, as well as help and advice with fundraising, financial modelling, and post-deal support, as we have been able to not only work on more than one deal at a time but also on much bigger transactions.”

It has also resulted in more business coming from outside Old Mill’s existing client base.

Kathryn added: “Previously, we were mainly working with existing clients but increasingly, non-client firms are coming to Old Mill specifically because of our reputation within corporate finance and we now have the capacity to help them.”

She said Old Mill’s appeal was its ability to offer a professional service that cuts out the jargon and puts the client at the heart of everything they do.

“Our role is to help businesses realise their true value,” she said. “We understand that the right choice isn’t just about financial returns – we work closely with our clients to gain a deep understanding so we can advise them on the best deal for them.

“Old Mill is an ambitious and growing firm, and a big part of our own growth strategy is around making the right acquisitions.

“We therefore understand that M&A is about more than just financials, and we can tap into this experience to help businesses find the right fit both operationally and strategically.”

Having doubled in size, Old Mill’s corporate finance team is looking to expand further, working with more businesses and attracting new talent.

“We operate an ‘open-door’ policy, which means talented, hardworking people who share our people centric culture will be welcomed into the firm,” said Kathryn.

“Both Scott and Tom contacted Old Mill speculatively and it was clear as soon as we met them that they would be great additions to the team, so we’d love to encourage others to get in touch.”

Pictured: Old Mill’s expanded corporate finance team. From left: Tom Downes, Mark Neath, Scott Hill and Kathryn Mansell